SalesFuel is a recognized leader in providing sales intelligence, marketing research and sales training that generates high ROI for our clients.

Sales Research

You'll Stand Apart by Using Exclusive Insights

SalesFuel is a leading publisher of proprietary sales and marketing research. We give salespeople and marketers the competitive edge with exclusive insights you won't find through AI or a Google search.

Our AudienceSCAN® study provides up-to-date consumer psychographics, audience segmentation and buyer personas.

Sales managers and sales teams represent another area of focus for SalesFuel as we regularly publish special reports on the state of the sales industry.

B2B Business Intelligence

You'll Reduce the Time Needed for Sales Preparation

SalesFuel goes deeper than just contact names and lists. We analyze trends, opportunities and headwinds for more than 440 vertical categories. SalesCred® PRO also provides real-time, strategic B2B intelligence, as well as competitive intelligence, in just 90 seconds.

Our licensed databases contain zip code-level consumer spending, health conditions, housing data, market demographics, ancestry and more.

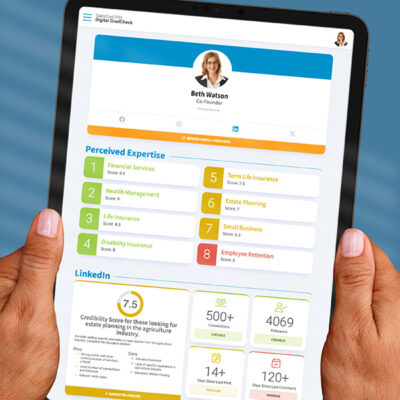

Sales Credibility

Your Team Will Build Their Credibility Online and In Person

Led by Global Sales Credibility Authority C. Lee Smith, SalesFuel empowers salespeople and executive leadership with The Power to Be Taken Seriously.™

Your sales team will build trust faster with SalesCred® — the platform all sales professionals need to measure and improve their sales credibility as serious people who know what they're talking about and know how to help.

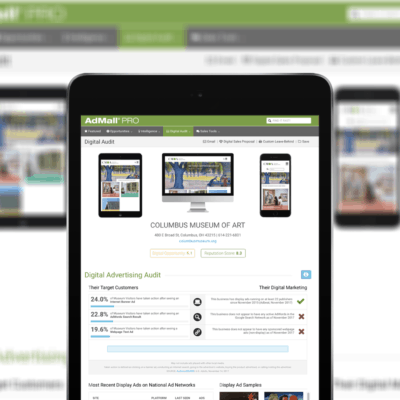

Marketing Intelligence

You'll Improve ROAS, Lead Gen and Marketing Impact

Our AudienceSCAN® study delivers exclusive psychographics, pre-purchase research tendencies and early-cycle purchase intent for more than 1,350 consumer audiences and B2B decision-makers.

AdMall® delivers marketing research, ad spend and promotional opportunities to media sales teams, advertising agencies and brand marketers. We also maintain a database of co-op advertising policies for thousands of brands.

Sales Management Intelligence

You'll Develop High-Performing Teams with Greater Confidence

Hire salespeople with the will to sell and keep them longer using proven, time-tested psychometric assessments.

TeamTrait™ takes the guesswork out of motivation and the emotion out of difficult conversations. It even helps you identify and develop future team leaders.

Sales Enablement

You'll Train Your Team to Sell with Foresight and Credibility

For more than 35 years, SalesFuel has trained thousands of sales reps on how to provide Relevant Insight™ to buyers. Our training programs teach sales reps how to Sell Smarter® using proprietary research and a client-centric approach.

Our CEO, C. Lee Smith, is available for sales kickoffs, keynote presentations, sales consulting and credibility coaching.

SALESFUEL IS TRUSTED BY HUNDREDS OF LEADING COMPANIES

FREE REPORTS AND E‑BOOKS FROM SALESFUEL

FREE ON-DEMAND WEBINARS

SalesFuel is

RESEARCH FOR REVENUE GENERATORS™