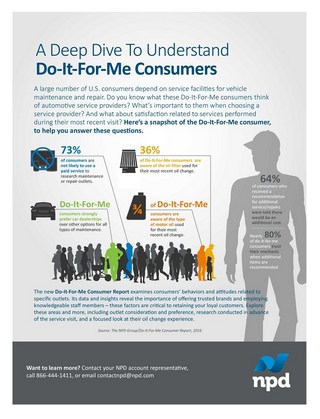

The majority of automotive do-it-for-me consumers have shifted more of their vehicle maintenance and repairs to a professional, according to market research firm NPD Group Inc., which cited convenience as the leading reason.

The preferred type of vehicle service professional — car dealership, quick lube or independent repair shop— shifts and varies, NPD said, depending primarily on vehicle age.

Many consumers trade among these different service outlets during the life of their vehicle. For example, among DIFM consumers with vehicles still under warranty, 16 percent will consider transitioning to a new outlet in the near future, while more than one-quarter are unsure how they will handle their future service needs, NPD said in its Do-It-For-Me Consumer Report 2016.

Auto service providers could focus on sports car owners in their campaigns, since AudienceSCAN data says Potential Auto Service Provider Switchers are 212% more likely than average to own and drive sports cars.

“This uncertainty represents an opportunity for service outlets to appeal to this consumer group, in an effort to capture their future service dollars,” said Nathan Shipley, director and automotive industry analyst.

“Achieving customer loyalty takes effort in this competitive service environment, but it all boils down to a matter of trust. Trust is critical, as it is the most important factor for consumers when determining where to take their vehicle for service.”

Service stations could emphasize their trust-worthiness in direct mail campaigns. According to AudienceSCAN research, 50% of Potential Auto Service Provider Switchers took action after receiving Ads/Coupons in their mailboxes in the past month.

Consumer preference is highest for car dealerships when it comes to simple jobs such as changing oil, fluids or wiper blades, NPD said, and advanced jobs such as replacing starters, brake pads or spark plugs.

Dealer service stations can focus on BMW owners and Hyundai owners, because AudienceSCAN data reveals 11% of Potential Auto Service Provider Switchers drive these brands.

Consideration steadily declines as the vehicle ages, the research firm said, with quick lube outlets gaining the highest consideration for simple jobs during the post-warranty period beginning after three years. Independent/local repair shops lead for advanced maintenance among vehicles eight years and older, while dealerships retain the highest consideration for complex jobs such as full engine, transmission or driveshaft repairs until the vehicle is 16 years and older.

“Service providers should focus on inspiring trust and communicating their knowledgeable staff, fair pricing, promotions, and availability of services to build a returning customer base,” Mr. Shipley said. “Encouraging satisfied customers to review their service experience online is also important, seeing as many consumers conduct research via search engine reviews and consumer feedback websites prior to selecting a service provider.”

In fact, this year's AudienceSCAN survey finds during the past 6 months, 33.4% of Potential Auto Service Provider Switchers have used the internet via browser, tablet or mobile phone to post a review about a local business.

NPD used an online survey, of a nationally representative sample of individuals aged 18+ in the U.S., for its report. Respondents must own or lease a vehicle, have at least some responsibility for vehicle maintenance and repair decisions, and have had a service performed in the past six months on the vehicle they drive most often.

AudienceSCAN data is available as part of a subscription to AdMall for Agencies, or with the SalesFuel API. Media companies can access AudienceSCAN data through the AudienceSCAN Reports in AdMall.