Digital Marketing

How digital marketing reps are generating thousands in new business every week

When you sell digital marketing services, you face plenty of competition. You must show your clients how their investment will return the ROI they want. Here's how several digital marketers did exactly that.

Armed with AdMall®, they had the ability stand apart from all the other SEO and digital marketing "experts." In fact, most business development reps pay for entire year of AdMall sales intelligence with just a single sale. And you can get a free trial so you can do the same!

It's the #1 sales research tool for local digital marketing sales for a reason. The results speak for themselves!

- A real estate legal firm was looking for more qualified leads when they were contacted by a digital marketing rep who knew the importance of AdMall’s Digital Audit. With that tool, they showed the prospect how their SEO tactics were falling short. Their homepage was not ranking high enough on the search engine results pages. After pitching a digital marketing services package, the rep generated a $35,000 sale. And the clients reported strong improvement in lead generation within 45 days.

- Grocery stores can be notoriously slow to adjust their advertising strategies. One savvy media sales rep showed their local grocery store an AudienceSCAN profile which indicated how heavily millennials shoppers use digital media formats, ranging from coupons to video. The store owner heard the rep’s pitch based on AdMall’s Digital Audit and AudienceSCAN data. They agreed to a campaign consisted of geofencing, retargeting and pre-roll video, and the new digital revenue for the media seller amounted to over $114,000. With new customers entering the store, the grocer attributed part of the success to the campaign’s video completion rate of 34.6%.

- After a local golf cart dealer moved to a new location, they wanted their customers to follow them. This was an especially important goal as a competitor had started up near their old location. The rep used AdMall to geotarget consumers in specific zip codes as they developed their proposal. In addition, the Digital Audit results proved crucial in terms of tracking the kind of digital advertising the competitor was engaging in. With that data, the rep sold a package for $10,000 in the first year and followed up with another $35,000 sale in the second year because the client was so impressed with the results.

- When a digital marketing rep needed to show an equipment rental center how to reach business clients, they turned to AdMall’s Digital Audit. The tool listed the specific keywords generating traffic in that vertical. The rep proposed a $12,000 SEO-based sprint to help the client reach commercial clients and came away with a one-year contract.

- In the months following the COVID-19-related shutdown, a local art gallery was seeking ways to re-engage potential visitors. Using AdMall’s AudienceSCAN profile on Arts Supporters, the digital marketing rep found promising information for the gallery owner. This audience responds to digital advertising. The rep presented a campaign that included Facebook and OTT advertising, along with traditional media. After the $90,000 contract was signed, the 12-month campaign ran in the local market to attract art lovers to the bricks-and-mortar destination.

Get exclusive insights that set you apart from competitors.

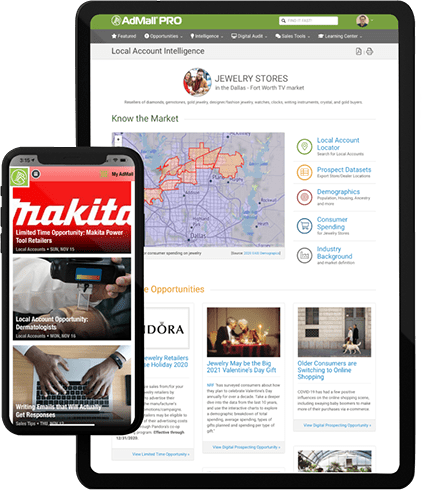

Digital Audit™ real-time marketing analysis in seconds.

AdMall’s Digital Audit does in 60 seconds what would take you 60 minutes to do by hand. This exclusive tool conducts a real-time data capture of any client or prospect’s digital presence and reveals where their digital marketing is falling short.

Using real-time big data, Digital Audit analyzes the account’s advertising, marketing activity, reputation and findability. It then helps them to meet their customer's where they are online — comparing their activity to the pre-purchase research methods used most by customers who intend to buy what they’re selling in the next 12 months. It's also an excellent competitive intelligence tool!

AudienceSCAN® digital marketing segmentation.

With extensive profiles of over 1,355 customer groups, AdMall's exclusive AudienceSCAN research provides unparalleled insights into consumer behavior, purchase intent, digital and technology usage, health and wellness concerns, automotive preferences, leisure interests, dining habits, and more.

Whether you're a business development specialist seeking new opportunities or a digital rockstar aiming to boost traffic, AudienceSCAN empowers you to make data-driven decisions. By reaching the people who truly matter and crafting messages that resonate, you can maximize your marketing efforts and drive conversions like never before.

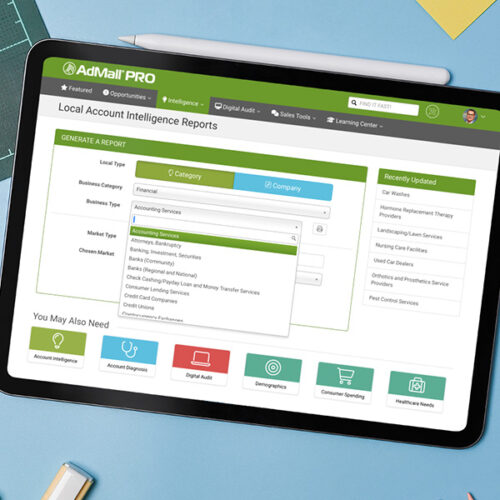

Category analysis, trends, and benchmarks for 400+ verticals.

Unlock the key to more effective campaigns with AdMall's unparalleled business intelligence. Our platform provides you with the insights necessary to create targeted, impactful campaigns that resonate with your audience.

From market-specific data to expert analysis across various verticals, AdMall empowers you to make data-driven decisions and optimize your strategies. Whether you're refining your messaging, identifying new opportunities, or fine-tuning your targeting, AdMall equips you with the tools to build campaigns that drive exceptional results.

Co-op advertising and marketing allowance programs for expanding budgets.

Co-op advertising plans, marketing allowance programs and business development funds researched by AdMall present a golden opportunity for digital marketing consultants and your retail clients. By tapping into our exclusive database, you can boost your clients' online presence with paid advertising that helps them reach a wider audience.

Use AdMall to expand their marketing budgets and increase your billings. All while demonstrating your consultancy's expertise and fostering long-term growth for your clients in a cost-effective manner.

Our clients include DIGITAL MARKETING TEAMS of nearly every type and size across the U.S.

Build your credibility as the local

digital marketing expert with AdMall.

- Help them make sense of it all with AdMall's exclusive Digital Audit featuring curated data from multiple platforms all in one place

- Get the insight needed to win your next big account with AdMall's category research and analysis

- Know your client's customer using proprietary AudienceSCAN buyer personas, psychographics and consumer segmentation.

- Improve geo-targeting results with consumer spending, health care needs, employment and more down to the zip code level

- Expand marketing budgets with co-op advertising and market development funds

- Access insights from anywhere within seconds with the AdMall mobile app

Grow your digital revenue with

3 types of intelligence from AdMall.

SALES INTELLIGENCE

AdMall builds sales credibility so your new business hunters can be seen as trusted advisors that generate leads for future clients

MARKETING INTELLIGENCE

AdMall is the most trusted digital market research and market intelligence tool for media companies and small-to-midsize agencies in the United States

BUSINESS INTELLIGENCE

AdMall delivers pre-sales research and digital marketing intelligence for understanding B2C, B2B, and franchise businesses