Video calling, shopping and video streaming see the highest smartphone usage growth among millennials. Shifts in usage behavior across all smartphone users is nearly triple the amount of video data consumed monthly per user in Q2 2016 vs. the year prior, according to NPD Connected Intelligence.

Whether at home or on-the-go, Millennials are leveraging their smartphones increasingly across a number of activities. From Q2 2015 to Q2 2016, the number of Millennials reportedly using their smartphones for video calling has increased 14 points (to 56 percent), for shopping has increased 10 points (to 59 percent), and for video streaming has increased 9 points (to 40 percent), according to The NPD Group Connected Intelligence Application & Convergence Report.

This is good news for wireless dealers seeking customers ready to switch carriers. This year's AudienceSCAN study found 11.8% of U.S. adults would like to switch to a different mobile/wireless provider in the next 12 months.

The report analyzes consumer use of smartphones, connected TVs and tablets; examining which content resonates on each device. For Millennials (aged 18 to 34) ownership and usage of computers is declining, as smartphones are leveraged increasingly for Facebook, posting pictures and/or videos, shopping, video calling, reading, streaming video and viewing files from their computer. As Millennials continue to increasingly use their smartphones, especially for activities involving video (video calling, posting and streaming), there is a need for and a migration to larger data plans.

Millennials might be migrating toward larger plans with new carriers. The AudienceSCAN survey reported 27.3% of Potential Mobile/Wireless Network Switchers are aged 25 to 34.

“Year-over-year we are seeing smartphone usage steadily increase among Millennials, especially as it relates to video features, which are often data-heavy actions,” said John Buffone, executive director, industry analyst, NPD Connected Intelligence. “As next-gen smartphones come to market, video sharing, streaming and calling will continue to grow, and this has spurred new offers from mobile carriers in an effort to grow their consumer base.”

Networks can reach these mega streamers with television (over-the-air, online, mobile or tablet) commercials. According to AudienceSCAN data, 46.2% of potential switchers took action in the past 30 days, after seeing them.

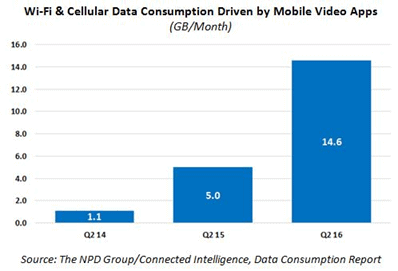

Video Streaming Drives Data Consumption Among All Smartphone Users

In addition to the increasing data needs of Millennials leveraging smartphones for video calling, posting and streaming, cellular data video consumption is being driven by demand from all smartphone users. According to NPD’s Connected Intelligence Data Consumption Report cellular data video consumption increased 130 percent over the past year (Q2 2015 to Q2 2016). With mobile video consumption on Wi-Fi networks included, the growth rate increases to 192 percent and totals nearly 15GB of data per smartphone user per month, up from 5GB the year prior. While data consumption is already growing, the introduction of zero-rated data plans from mobile carriers will accelerate this trend, as users will be able to stream video content without using their data allowance.

Ads featuring larger data plans and carry-over plans could be effective in swaying switchers. According to AudienceSCAN research, 40% of potential switchers took action based on sponsored search results (like on Google, Yahoo or Bing).

“Mobile carriers are leveraging these plans to appeal to consumers who are often concerned about data overages and to stand out from the competition,” said Brad Akyuz, director, industry analyst, NPD Connected Intelligence. “As mobile carriers continue to promote new offerings that encourage video streaming and with over two-thirds of consumers opting for phones that are ideal for video, with screens 4.7‑inch or greater, we expect to see data usage continue to grow.”

AudienceSCAN data is available as part of a subscription to AdMall for Agencies, or with the SalesFuel API. Media companies can access AudienceSCAN data through the AudienceSCAN Reports in AdMall.