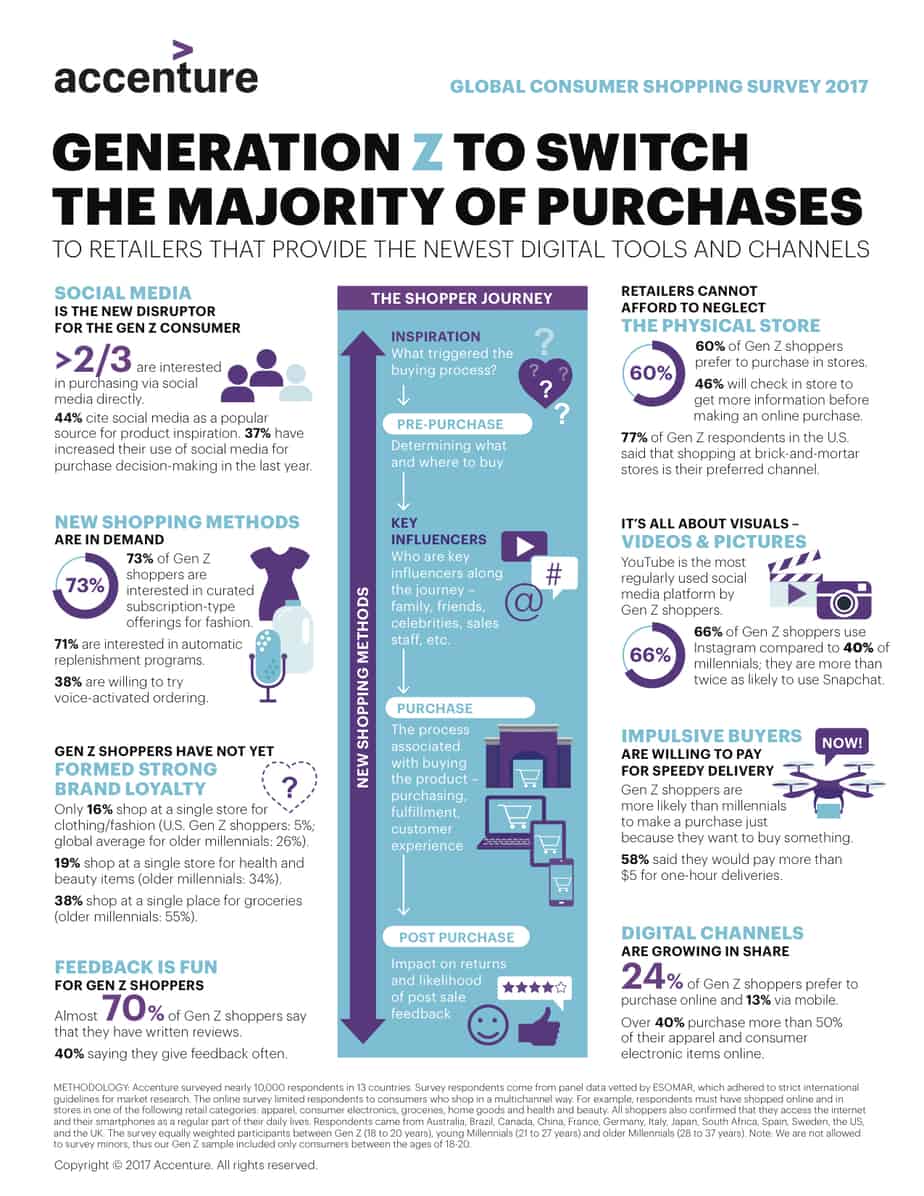

Generation Z will switch the majority of purchases to retailers which provide the newest digital tools and channels, Accenture research reveals. Young consumers seek voice-activated ordering, curated subscriptions and automatic-replenishment shopping models to be loyal.

Retailers looking to capture share of wallet and brand loyalty from the next generation of consumers – Gen Z – will need to step up their focus on new ways of engagement. This group is looking for enhanced digital tools such as the ability to purchase directly via visual social platforms including YouTube, Facebook, Instagram and Snapchat, according to new global consumer research from Accenture.

Stepping up the loyalty game could be beneficial for ALL customers, not just Gen Z. The latest AudienceSCAN study found only 11.5% of adults have at least ten loyalty cards/programs/apps that they use regularly.

The research, based on a survey of nearly 10,000 consumers across 13 countries, examines the attitudes and expectations of millennial and Gen Z consumers along the path to purchase. The survey revealed some distinct shopping habits and preferences among Gen Z consumers, which make it imperative for retailers to further rethink and redesign their digital shopping capabilities and methods.

Because the AudienceSCAN survey revealed 34% of Loyalty Card/App Users have used their smartphones to compare pricing at a competitor while shopping in the past 6 months, retailers need to give them reasons to stay loyal.

They haven’t formed strong brand loyalty. Only 16 percent of Gen Z’s shop at a single store for clothing/fashion (compared with 26 percent of older millennials); only 19 percent shop at a single store for health and beauty items (compared with 34 percent of older millennials); and fewer than 38 percent shop at a single place for groceries (compared with 55 percent of older millennials). In the United States, brand loyalty among Gen Z is even weaker, with only five percent of U.S. Gen Zs shopping at a single place for clothing.

These stores can invite loyalty by promoting the benefits in TV spots. The AudienceSCAN study reported 34% of Loyalty Card/App Users took action after watching commercials in the past month.

Social media is set to become a major direct shopping channel for Gen Z with more than two-thirds (69 percent) of them interested in purchasing via social media directly. In addition, more than four in 10 Gen Z’s (44 percent) cite social media as a popular source for product inspiration, and more than one-third (37 percent) have increased their use of social media for purchase decision-making in the last year.

At the same time, however, the findings show that retailers cannot afford to neglect the physical store, since 60 percent of Gen Z shoppers still prefer to purchase in-store, and nearly half (46 percent) will still check in store to get more information before making an online purchase. In the U.S., over three-quarters (77 percent) of Gen Z respondents said that brick-and-mortar stores is their preferred shopping channel.

Emails could persuade loyal customers to come into physical stores. According to AudienceSCAN data, 32% of Loyalty Card/App Users took action after receiving emailed ads or newsletters in the past 30 days.

The research also revealed that Gen Z shoppers are interested in new shopping methods. Nearly three-quarters (73 percent) of Gen Z shoppers are interested in curated subscription-type offering for fashion, and 71 percent are interested in automatic-replenishment programs, with an overwhelming majority willing to shift more than half their purchases to a retailer offering this service. Additionally, 38 percent of Gen Z’s are willing to try voice-activated ordering, while 25 percent of them said they can’t wait to use it and 10 percent of them said they are already using it.

Other key findings regarding Gen Z shoppers:

They are all about visuals — videos and pictures. YouTube is the most-regularly used social media platform, cited by 84 percent of Gen Z respondents, while Facebook is still the most-popular social platform for both younger (21–27 years old) and older (28–37 years old) millennials. Two-thirds (66 percent) of Gen Z shoppers regularly use Instagram, compared with only 40 percent of millennials, and Gen Z shoppers are more than twice as likely as millennials to use Snapchat (54 percent versus 38 percent for younger and 22 percent for older millennials).

They regularly turn to their ‘influencer’ circles. Gen Z consumers are more likely than both younger and older millennials to purchase an item due to: what their family thinks; recommendations from watching YouTube videos; what their friends think; and comments on social media. In addition, when shopping online Gen Z’s are usually more likely than both younger and older millennials to: chat with an online sales assistant; check in store for more information; ask friends’ opinions via social media, text or phone; and ask family members’ opinions via social media, text or phone.

They are impulsive buyers and willing to pay for speedy delivery. Gen Z shoppers are more likely than millennials to make a purchase because: they just wanted to buy something; they randomly saw something they liked; or it was recommended by a friend or family member. In addition, Gen Z’s crave speedy delivery more than millennials do and are willing to pay for it. In fact, more than half (58 percent) of Gen Z respondents said they would pay more than $5 for one-hour deliveries.

“Gen Z is the next big consumer market and purchasing powerhouse,” said Standish. “Retailers need to invest in the digital tools that will enable them to speak to Gen Z through visuals, collaborate with them across multiple channels and devices, and make them feel part of their brand. Offering services such as crowd-sourcing, customization and hyper-personalization are a must-have capability for reaching a generation that is shaping and commanding today’s digital retail landscape.”

AudienceSCAN data is available as part of a subscription to AdMall for Agencies, or with the SalesFuel API. Media companies can access AudienceSCAN data through the AudienceSCAN Reports in AdMall.