"Almond milk is now America’s favorite milk substitute, boasting sales growth of 250% over the past five years. During that same period, however, the total milk market shrunk by more than $1 billion. And while almond milk still accounts for just a fraction of the total milk market (about 5%), it brings in more than twice the revenue of the other substitutes combined."

"There's quite a number of people with dairy allergies, and there's quite a number of people who are vegetarian or vegan who don't necessarily want to drink dairy," said Dean Kallas, grocery category manager at the Willy Street Co-op in Madison. The global market for milk alternatives reached $5.8 billion in 2014 and should reach nearly $10.9 billion by 2019, according to the market research firm, BCC Research.

Shoppers such as vegetarian Bailey Lyons and her wife, Rhea Lyons, picked up Almond Breeze almond milk for its taste and because of how it fits into their personal ethics. "We buy it because we like it better, it's better in cereal, it's better in baking, and it doesn't come with the guilt associated with buying cow's milk," Bailey said.

This is important when you consider the fact that the latest AudienceSCAN survey found 4.1% of Americans describe themselves as vegetarian or vegan.

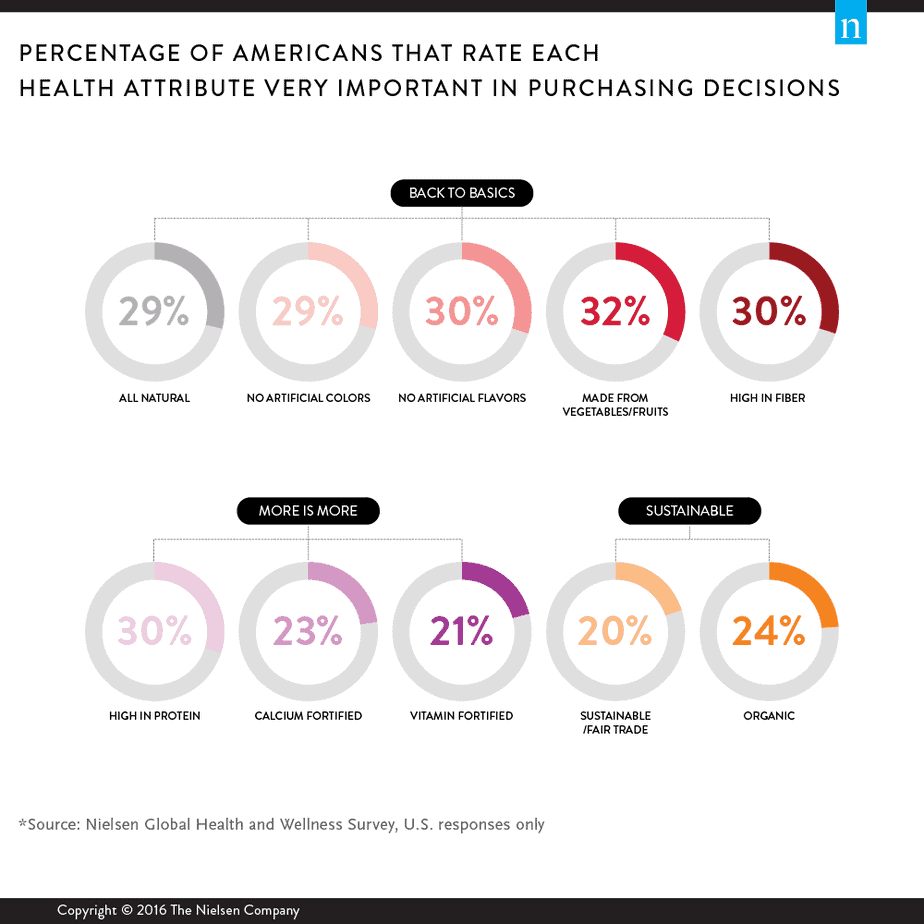

The uptrend in sales is likely the result of current health and wellness trends. According to Nielsen’s 2015 Global Health and Wellness survey, consumers rated back-to-basics food attributes like “all natural,” “no artificial colors or flavors” and “made from vegetables or fruits” the most important.

"While health attributes are important factors in purchase decisions for all age groups, certain attributes are more important to younger generations," Nielsen reported. "Forty percent of Generation Z respondents in the global health and wellness survey said ingredients sourced sustainably are very important in their purchase decisions, followed by Millennial (38%) and Generation X (34%) respondents, compared with only 21% of Silent Generation respondents."

Grocers and retailers selling milk should consider promoting the milk alternatives they have in stock too. Especially when you consider 16% of Vegetarians/Vegans want to buy things that make them feel "compassionate," the most recent AudienceSCAN data reported.

"Dietary restrictions may also be playing a part in the rise of almond milk, as it lacks the lactose of traditional milk and the hormones found in soy. In fact, products labeled hormone or antibiotic free have posted double-digit growth over the past four years. They also generated $11.4 billion in sales last year. And products labeled as lactose free saw sales of $8.7 billion and grew 8.6% in the last four years."

"Despite the huge growth in almond milk sales between 2011 and 2014, the pace did slow a bit in 2015, suggesting a potential plateau on the horizon. Regardless of the slowdown, it’s clear that when it comes to milk, health benefits play a major role in purchasing decisions."

AudienceSCAN data is available as part of a subscription to AdMall for Agencies, or with the SalesFuel API. Media companies can access AudienceSCAN data through the AudienceSCAN Reports in AdMall.