The U.S. athletic footwear industry grew by 8 percent in 2015, generating $17.2 billion and marking one of the best performances the industry has had in a number of years, according to global information company The NPD Group. Unit sales grew by 3 percent and average selling price by 5 percent, to $61.15.

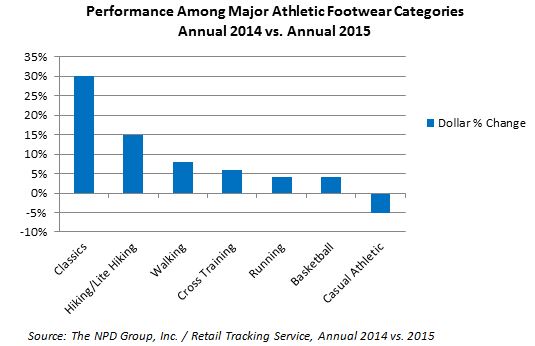

"While there was tremendous volatility at the category level, the overall strength of the industry was clearly evident in 2015,” said Matt Powell, vice president and sports industry analyst, The NPD Group. “Performance footwear, particularly running and basketball, cooled off in 2015 and we saw a rise in the more casual and retro styles. This will be an important trend to watch in 2016. The hiking shoe category has also been, and should remain, strong as we continue to see the merging of outdoor and athletic.

AudienceSCAN reported 17.9% of Americans intend to purchase athletic footwear in the next 12 months. 52.3% of them are women.

The strongest growth of the year came from the $3.5 billion Classics category, which grew by 30 percent in 2015 and is capturing share from other major categories. This growth was driven by retro basketball and retro running shoes. The Classics trend is evident among all consumers, as the category showed substantial sales increases among men (+26 percent), women (+69 percent), and children (+29 percent) alike.

This trend makes sense when you know that 30.5% of Athletic Footwear Shoppers are into fashion (clothing, shoes, handbags, etc.), according to AudienceSCAN data.

Holiday 2015 Performance

Coinciding with the holiday season, athletic footwear sales peak in December. The final month of 2015 was one of the best in terms of sales growth for athletic footwear. Total dollar sales grew 13 percent, unit sales by 10 percent, and average selling price by 3 percent compared to December 2014. Classics experienced the strongest growth during this time as well, with a 63 percent rise in dollar sales.

Try reaching Athletic Footwear Shoppers in emailed ads or newsletter ads, because AudienceSCAN found 31.5% of them took action after checking their inboxes during the past month.

“I expect to see the positive momentum we saw from athletic footwear throughout 2015 continue in 2016,” said Powell. “The athleisure trend has helped the acceleration of growth, as has social fitness, which will continue to shape the sports business as class-based fitness activities and other shared experiences will dominate the industry. Brands and retailers must integrate this trend into their plans. It will be necessary for them to capitalize on social fitness in order to grow in the months ahead."

AudienceSCAN data is available as part of a subscription to AdMall for Agencies, or with the SalesFuel API. Media companies can access AudienceSCAN data through the AudienceSCAN Reports in AdMall.