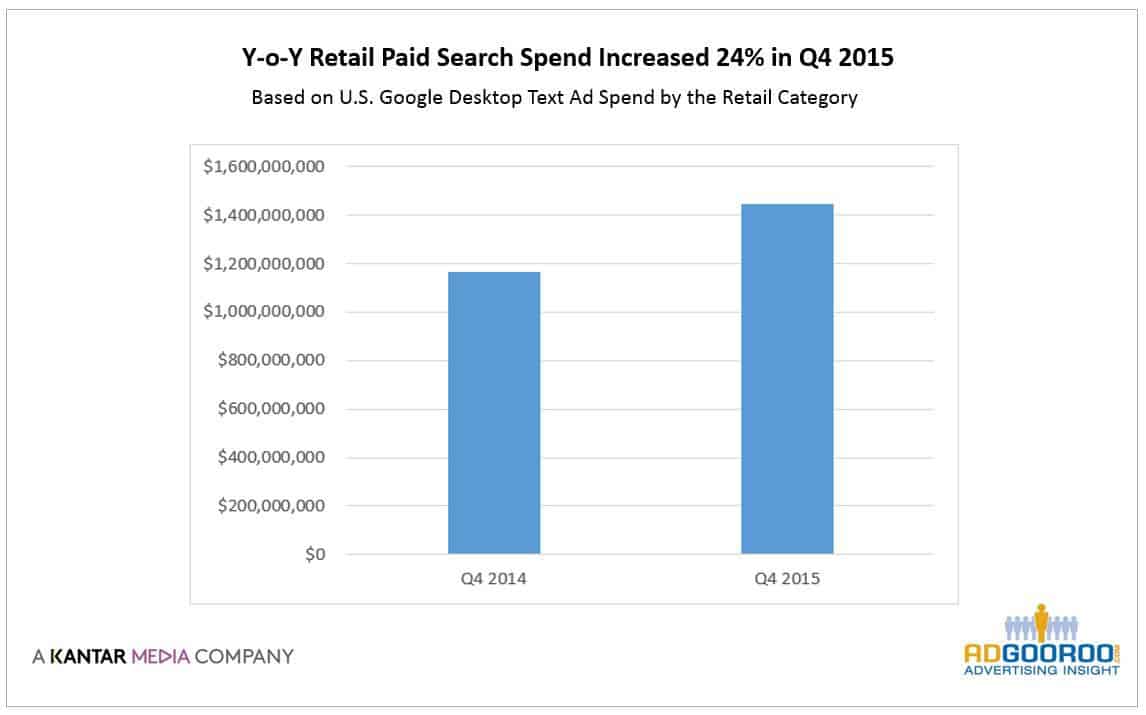

The retail category may see a significant increase in paid search advertising spending this holiday season, according to new research by AdGooroo. In a study of U.S. Google desktop text ad activity on the top 150,000 retail keywords by paid search spend, AdGooroo found that retailers boosted their year-over-year spend by 24% last holiday season, spending $1.44 billion in Q4 2015 compared to $1.16 billion in Q4 2014.

What’s more, year-over-year spending in the category increased by 31% in the first eight months of 2016, jumping from $2.35 billion spent on the 150,000 keywords from January through August 2015 to $3.08 billion spent during those same months this year.

Should this trend continue through the remainder of 2016, the retail category will likely see a double digit increase in paid search advertising spending this holiday season for desktop text ads.

The primary reason retailers spend more in the fourth quarter, of course, is that more consumers will be shopping for the holiday season, says the report. This phenomenon is reflected in an increase in consumer clicks on retail paid search ads in the fourth quarter. Consumer clicks on retail paid search ads averaged 558 million per month in Q4 2015 compared to an average of 330 million clicks per month in the first three quarters of the year, a 69% average increase in clicks, says the report.

Retailers are well aware of the importance of Black Friday in driving Q4 sales, both in stores and online, says the report. In fact, according to the National Retail Federation, 103 million U.S. consumers shopped online over the Thanksgiving-Black Friday weekend in 2015, one million more than shopped in brick-and-mortar stores.

According to the AudienceSCAN survey, 32.6% of U.S. adults went shopping in stores (not online) on Black Friday in 2015.

To help drive a successful paid search strategy for Black Friday, retail advertisers should consider sponsoring Black Friday-specific keywords, i.e. keywords that include the term ‘black friday’, says the report. In 2015, the study found 161 Black Friday-specific keywords generated $19 million in U.S. Google desktop text ad spend during the fourth quarter. The top Black Friday keyword, ‘black friday 2015’, alone drove $11.7 million in spend in Q4, ranking it #5 in U.S. Google desktop text ad spend among all retail keywords for the full year of 2015. In 2014, the keyword ‘black Friday 2014’ appeared 4th in the same ranking.

The AudienceSCAN survey found 35.7% of Black Friday Shoppers took action based on sponsored search results (like on Google, Yahoo or Bing) in the past month.

Looking at key retail subcategories that are popular for holiday gifts, apparel and consumer electronics, the study found significantly higher increases in Q4 competition in 2015. The number of advertisers sponsoring the top 1000 apparel keywords jumped 62% in Q4 2015 over Q1-Q3 2015, while the number of advertisers sponsoring the top 3000 consumer electronics keywords increased 41% in Q4 2015 compared to the first three quarters of the year.

Electronics retailers should consider sponsoring Black Friday key words related to hi-def televisions. AudienceSCAN research revealed 30.7% of Black Friday Shoppers intend to purchase High-Definition TVs.

Many advertisers, particularly smaller niche players such as flash sites, will hold back budget throughout the year to blitz the market during the holidays. For instance, according to the report, the site “blackfridaydiscount.net” spent $3.2 million on text ads campaigns in Q4 2015, placing it 10th in a ranking of the top 10 advertisers by text ad spend on the keyword group.

Aggressive niche advertisers can bump traditional retail advertisers from their position and siphon traffic during crucial shopping periods, as well as drive up cost per click, says the report. To help safeguard against such niche sites, suggests the report, retail advertisers should consider optimizing their campaigns early, ideally in September, including click through rates, ad copy and landing pages, to ensure a strong quality score relative to the competition.

December is the Top Month for Paid Search Spend

Conventional wisdom may lead to the assumption that November is the top month of the fourth quarter for paid search advertising (and online advertising in general), considering that the Thanksgiving-Black Friday sale weekend falls in November and that online shopping in December is truncated by the need to ship in time for Christmas.

However, AdGooroo’s examination of Q4 spending patterns on the top 150,000 keywords found that December is actually the top month of the fourth quarter for paid search spend, followed by November and October.

Retail advertisers spent $543 million on U.S. Google desktop text ads in December 2015, $510 million in November and $391 million in October. This spending pattern is consistent with Q4 2014 as well, as detailed in the above chart.

Retailers should take notice and plan their Q4 paid search budget accordingly.

Overall, AdGooroo has found that retail advertisers spent 36% of their total annual paid search budget in Q4 2015 and 34% of their annual paid search budget in Q4 2014. However, we’ve also found that the top advertisers in the retail category have spent up to 45% of their annual paid search budget in the fourth quarter, while some seasonal retail advertisers have spent as high as 85%.

AudienceSCAN data is available as part of a subscription to AdMall for Agencies, or with the SalesFuel API. Media companies can access AudienceSCAN data through the AudienceSCAN Reports in AdMall.