The just-released Internet Retailer Top 1000 reveals a number of surprising trends in North American e‑commerce. For one, the largest players in online retailing grew 14% last year to nearly $300 billion—not half bad considering store sales grew only 3%. Yet, for the first time in nine years Top 1000 merchants have grown slower than the U.S. e‑commerce market as a whole.

"As industries mature, their growth slows, and that’s starting to occur in online retailing," wrote for Internet Retailer.

"Still, there was plenty of growth among smaller online retailers. In fact, the Second 500, those North American retailers ranked Nos. 501‑1000, increased their web sales 14.9% in 2015 over 2014, ahead of the overall e‑retail market. And some of the smaller retailers in the Top 1000 grew rapidly in 2015 with innovative marketing concepts or by finding ways to sell online items previously sold mostly in stores."

Small businesses can compete in the online world! Especially if SMBs know what Online Shoppers plan to purchase. And AudienceSCAN has that data. 24.4% of Online Shoppers are looking for High-Definition TVs in the next 12 months.

"Web sales for U.S. e‑retailers grew 14.6% in 2015, far ahead of the 3.1% growth in store sales, according to U.S. Department of Commerce data, but still the lowest e‑retail growth since the end of the last recession."

22.3% of Online Shoppers intend to spend at least $500 on men's clothing in the next year, according to AudienceSCAN survey results.

"And a similar trend is showing up in the sales numbers coming out of the more established players and the fast-growing up and comers in North American e‑commerce, according to an analysis of just-released data on Internet Retailer’s global e‑commerce database website, Top500Guide.com."

17.5% of Online Shoppers are searching for video game systems, AudienceSCAN reports.

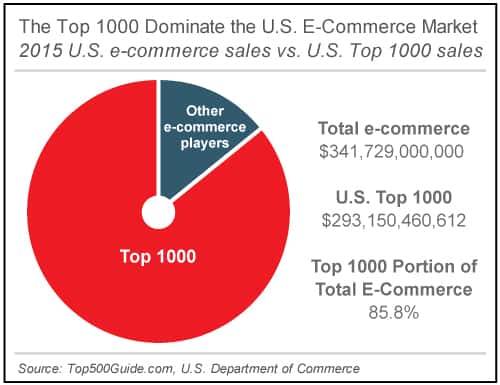

"Merchants ranked in the 2016 Top 500 Guide and Second 500 Guide—now part of the Top 1000—which collectively represent 85.8% of online retail sales in the U.S. only grew 13.5% in 2015 over 2014, well short of the U.S. e‑commerce growth rate. But all of that shortfall stems from the struggles of four retail chains—Sears Holdings Corp., Barnes & Noble Booksellers Inc., Lands’ End, and Staples Inc. —whose online sales collectively fell 5.3%. Without those four retailers the rest of the Top 1000 increased web sales by 14.6% in 2015, right in line with U.S. e‑commerce growth."

AudienceSCAN research shows 36.6% of Online Shoppers make a point of shopping where salespeople are helpful and friendly. Traditional retailers with online stores can boost foot traffic from online shoppers by having helpful and friendly salespeople.

"Much of that growth came from the No. 1 online retailer, Amazon.com Inc., which alone accounted for 60% of total e‑commerce sales growth last year, not to mention roughly 25% of all retail sales growth—online and off."

AudienceSCAN data is available as part of a subscription to AdMall for Agencies, or with the SalesFuel API. Media companies can access AudienceSCAN data through the AudienceSCAN Reports in AdMall.